Paul Reuge, European Equities Portfolio Manager Rothschild & Co Asset Management.

That’s the question that arises, given the brightening top-down and bottom-up outlook for the sector after a five-year period marked by covid, inflation and rising interest rates.

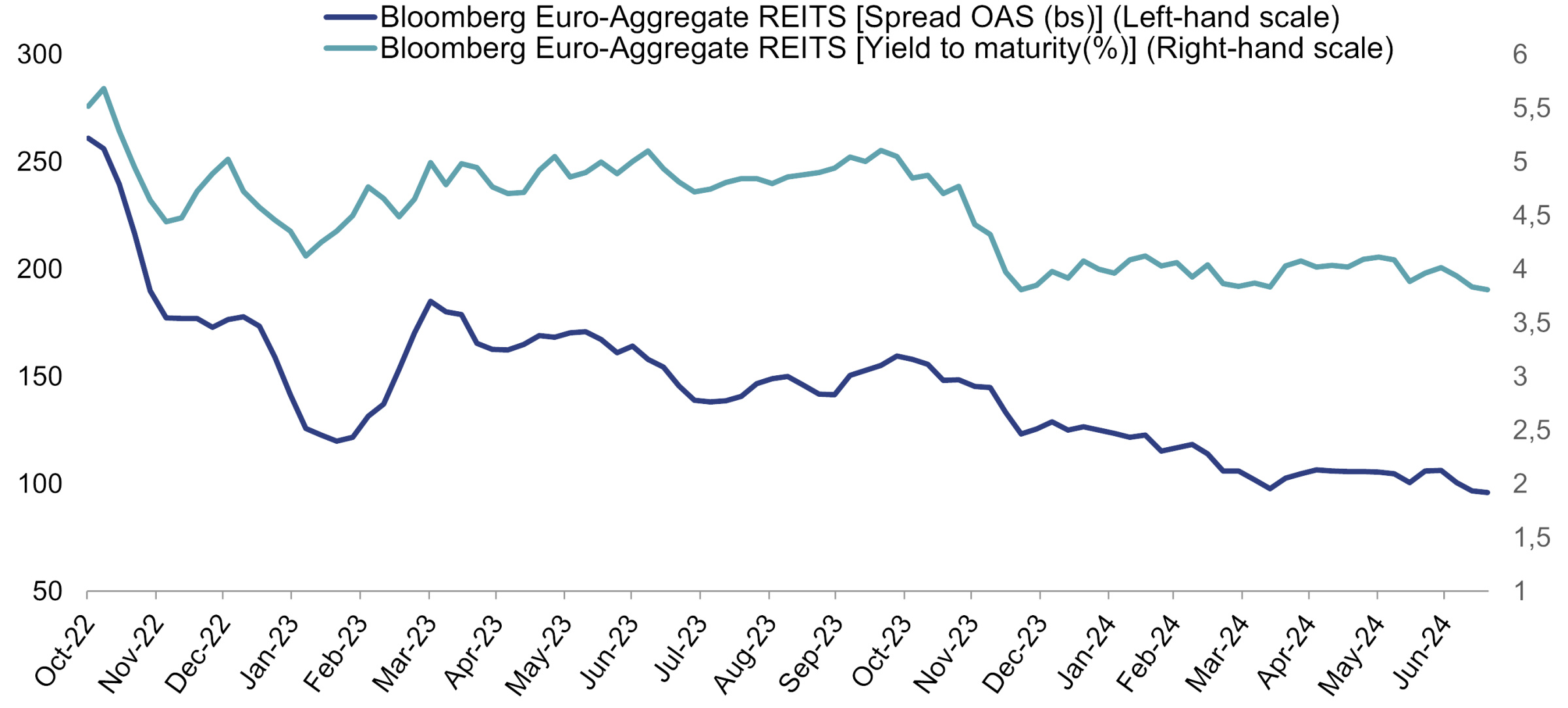

The expectation of a normalization of monetary policy after two years of rising interest rates has lifted the weight of uncertainty weighing on real estate companies, with the immediate effect of loosening financial conditions. After peaking in autumn 2022, the cost of refinancing companies began to fall at the end of 2023, with the prospect of a pivot point, thanks to a combination of lower rates and lower margins:

Source: Rothschild & Co Asset Management, september 2024.

The latest issues in early September fell below the 4% mark (Unibail Rodamco, 3.68% for 7.5 years)3. While the marginal cost is still higher than the cost of existing debt, the gap should continue to narrow, enabling the sector to sustain its growth. Moreover, disposals are less urgent for the most heavily-indebted companies, thus avoiding potential distressed sales and the associated loss of income. From a “bottom-up” perspective, and more specifically from the real estate markets, the low point in property valuations for the vast majority of asset classes was indeed reached as anticipated in the first half of 2024, with some real estate companies such as Klépierre even benefiting from slight revaluations (+2%)3. This is a strong signal of the attractiveness of the stock market discount to net assets values at the bottom of the cycle. This is still significant (25% for R-co Thematic Real Estate4 ), offering a comfortable entry point.

So, does this leave any good reason not to return to listed real estate companies?

The first reason could be the intensity and expected pace of rate cuts. It’s true that the slow decline in inflation has somewhat delayed central bank decisions and caused volatility in the sector. However, the latest economic indicators leave less and less doubt about the global slowdown underway, with the US job market, Eurozone growth and Chinese PMIs all weakening, foreshadowing a rate cut that is likely to be in line with market expectations. However, we can’t completely rule out the possibility that this convergence will cause further market volatility as contrasting macroeconomic indicators are released. This risk, for a medium- to long-term investment, seems to us to be contained and may, on the other hand, offer additional entry points.

Could the risk of recession represent a stronger headwind than the tailwind of falling interest rates?

It all depends on the type of real estate market we’re addressing. Offices (which account for 15% of the fund4) are by definition sensitive to the job market, and therefore to a recession. However, not all properties have the same risk profile, and central areas (around 80% of the fund’s office allocation4) with low vacancy would be much less affected than areas already abandoned by tenants. This would reinforce the current polarization of the market. Logistics (10% of allocation4) could see rental demand continue to slow, but here again long-term trends (reshoring in Europe) should limit the impact depending on the area. Retail (29% of allocation4), which depends on consumer spending, could experience a slowdown, but rising real consumer incomes and the diversity of retailers in shopping centers will act as a shock absorber. Following the advent of e-commerce and the covid crisis, shopping centers have also purged a good number of struggling retailers. Housing (30% of the fund4), on the other hand, would benefit from a recession. In Germany, this sector, which is defensive by construction, has a substantial growth potential, thanks to the significant gap between current rents and market rents, the convergence of which is hampered by restrictive regulations. Property companies investing in this segment would therefore benefit from continued strong rental growth, in addition to lower interest rates. The sectoral breakdown of the portfolio therefore makes it possible to manage, to a certain extent, the risk of an economic slowdown.

What about regulatory and political risks?

These are certainly the least predictable. The recent example of dissolution in France and the rent freeze in Berlin (2020) are good illustrations. Although housing is probably the most exposed, it benefits from a scarcity of supply (new construction has ground to a halt following the abrupt halt in the development market) and the need for renovation to meet the challenges of the energy transition, which should protect it from overly coercive political measures, as the state cannot do without private capital.

In conclusion, the financial markets seem to have taken the measure of the investment opportunity that the sector currently represents, posting the best performance of the Eurostoxx over 1, 3 and 6 months (as at September 16)³. There is still significant potential for appreciation (25% discount for the R-co Thematic Real Estate4 fund), which should attract generalist investors who are still underweight property companies.

[1] An approach that begins with a macroeconomic and geographical analysis of all sectors, in order to extract those with the greatest upside potential. Once this analysis has been completed, the investor must refine his study in order to select the stocks with the highest return according to his forecasts.

[2] A portfolio management technique that consists of investing in a company whose share price is believed to be undervalued by the market, despite its high return potential.

[3] Source: Bloomberg, September 2024.

[4] Source: Rothschild & Co Asset Management, September 2024.